paying indiana state taxes late

Property taxes are due twice a year and a 5 penalty is applied to your taxes if youre 30 days late sending your payment. Consequences of Not Filing or Paying State Taxes.

You must file an income tax return for Indiana if you live in the state year round and the total.

. Find IRS or Federal Tax Return deadline details. If you file your return more than 60 days after the due date or extended due date the minimum penalty is the smaller of 135 or 100 percent of the unpaid tax. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax.

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. There are several ways you can pay your Indiana state taxes. Penalty for Filing Late Taxes in Indiana Required Filers.

Late Payment and Failure to Withhold or Collect Tax as Required by Law - Two 2 percent of the total tax due for each 30 days or fraction thereof that a payment is late. Purchased online or via phone and shipped. What happens if you pay Indiana state taxes late.

You will not have. These conditions apply to all payments. If you need additional help or have.

The State of Indiana has a flat penalty charged to anyone who fails to pay or file on time. If a returned payment causes. If you dont have a bill or dont know the amount due you can get assistance by calling the Indiana Department of Revenue at 317.

There will be a 10 fee of total tax due for those who do not pay according to the dates listed above. Tax Penalties Failure to pay tax 10 of the unpaid tax liability or 5 whichever is greater. Find Indiana tax forms.

If your payment is returned for any reason there will be a 2500 NSF fee per county ordinance 09-23-19-A. Know when I will receive my tax refund. At the time of this writing the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas Washington and.

7 tax on property used consumed or stored in Indiana when the sales tax was not collected at the time of purchase Examples include property. You can find information on how to pay your bill including payment plan options FAQs and more below. The 2021 Indiana State Income Tax Return forms for Tax Year 2021 Jan.

31 2021 can be e-Filed together with the IRS Income Tax. And If an employee both lives. Property Tax Deductions If you meet specific.

The Indiana Department of Revenue wants to ensure that taxpayers are able to get access to the information and forms they need regarding back tax issues. This penalty is also imposed on. To avoid this penalty even if you cannot pay your Ohio Income Tax balance it is important you either file your Ohio Income Tax Return or a federal extension by the tax.

If you have specific questions about a bill call our payment services team at 317 232. States can assess penalties and take enforcement collection actions against taxpayers who have not filed a required tax return or. Due Date - Individual Returns - April 15 or same as IRS Extensions - Indiana requires all individual income taxpayers that do not file by the original due.

General Tax Return Information. Lower rate Indiana county income tax withholdings are required even if Indiana state tax is not withheld due to a reciprocity agreement with an adjoining state. Indiana state income tax.

The Best And Worst U S States For Taxpayers

Do I Have To File State Taxes H R Block

How High Are Cell Phone Taxes In Your State Tax Foundation

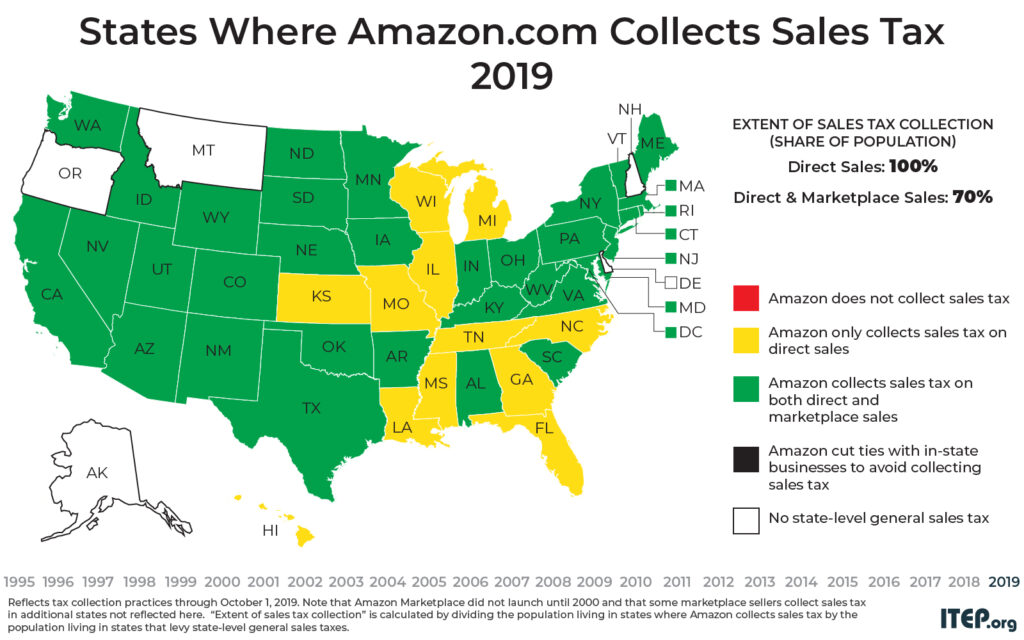

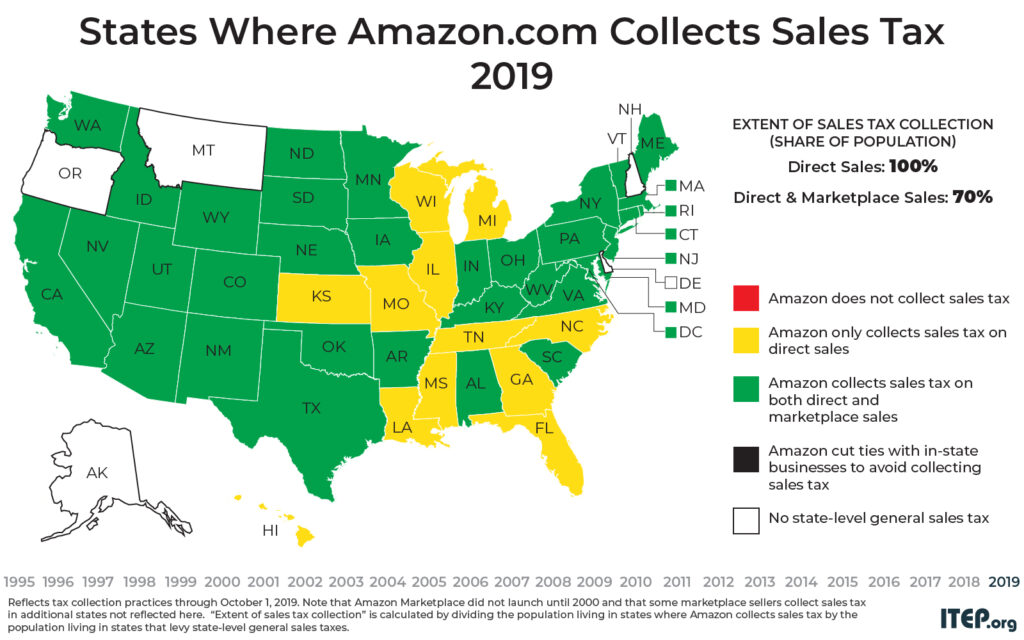

A Lump Of Coal For 12 States Not Collecting Marketplace Sales Taxes This Holiday Season Itep

Indiana Sales Tax Small Business Guide Truic

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

States With Highest And Lowest Sales Tax Rates

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

Sales Tax By State Is Saas Taxable Taxjar

Where S My State Refund Track Your Refund In Every State

Us State Tax Return Resources Sprintax Blog

2020 Tax Deadline Extension What You Need To Know Taxact

The Dual Tax Burden Of S Corporations Tax Foundation

How To Register For A Sales Tax Permit Taxjar

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)